Optimizing Stripe Fees for Your Business: Tips and Strategies

Launching your business quickly is crucial, but don't forget the importance of optimizing payment costs for the future of your online business.

This is a Part #2 post on card processing fees. I will explain in details how Stripe fees work and what to pay attention to when setting up Stripe account, so that you avoid unwanted costs.

Part #1 is about generic explanation of how card processing fees work. In case you missed it you can read it through here.

To unwrap Stripe fees, let’s start with two most basic factors:

Business location

Customer location

Business location

Stripe has a similar, but different fee structure depending on the country in which you registered your account.

The most important factor, defined by business location is the choice of settlement currency.

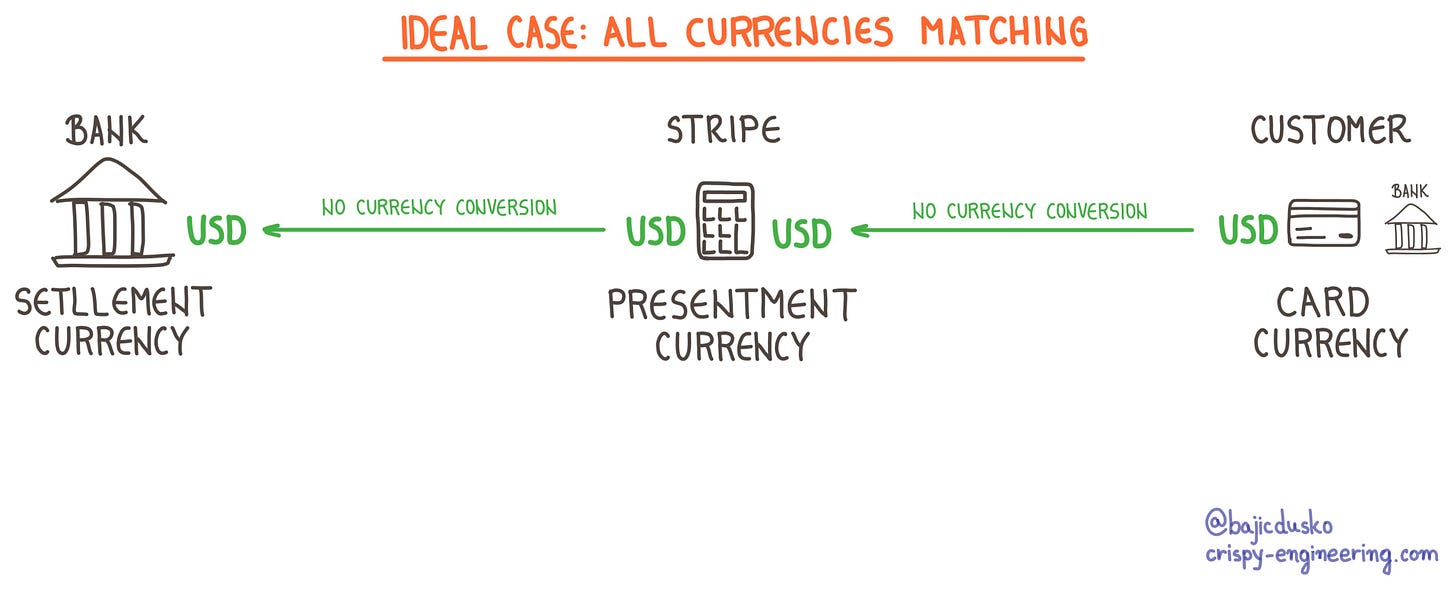

Settlement currency

Settlement currency is the currency of your bank account. Usually, this is the official currency of your country.

In some countries, you can set a default settlement currency to be USD, even if the official currency is some other (like EUR, or GBP). This is important because you will avoid currency conversions. With Stripe, you can set multiple bank accounts and have transactions automatically routed to a bank account with matching currency.

Depending on the type of business you’re running, you can make early optimization if you know where your future customers are coming from. This is a bit difficult for digital products, as your market is the whole world. Therefore, some other rules apply as well, as customer location plays a huge role.

Customer location

On the opposite side of the transaction flow, there is a customer with similar factors. What affects the card processing fee are the following:

country of residence

Location of the bank that issued your card.

credit card currency

This is the currency of your bank account, usually, the official currency of the customer’s country/region.

The parameters above are affecting whether additional fees will apply to the transaction flow. Those additional fees are:

cross-border fees (often called international payments)

currency conversion fees

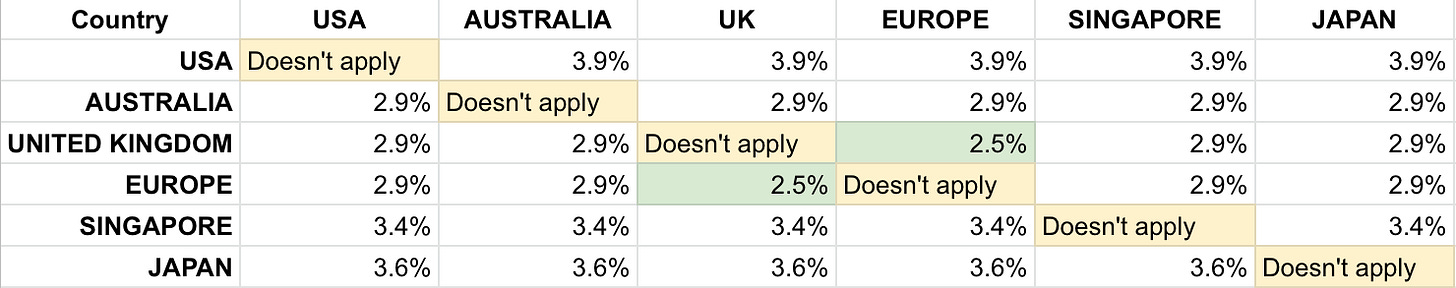

Cross-Border Fees (international payments)

Whenever someone uses a card issued in a country/region other than the country/region of a POS, a cross-border fee will apply. There is no difference in whether the card is present or not.

With Stripe, this is where it comes to play when you choose the country to register your Stripe account. Registering in the USA means that every payment with a card issued outside of the USA will have a cross-border fee added on top of the domestic fee.

In the table below, we can see payment processing fees with a cross-border fee included.

For someone running an online business, this table is more relevant than the previous one. If you’re globally present, selling digital products, chances are you will have many international buyers.

Currency conversion

With currency conversion in place, things get very shady.

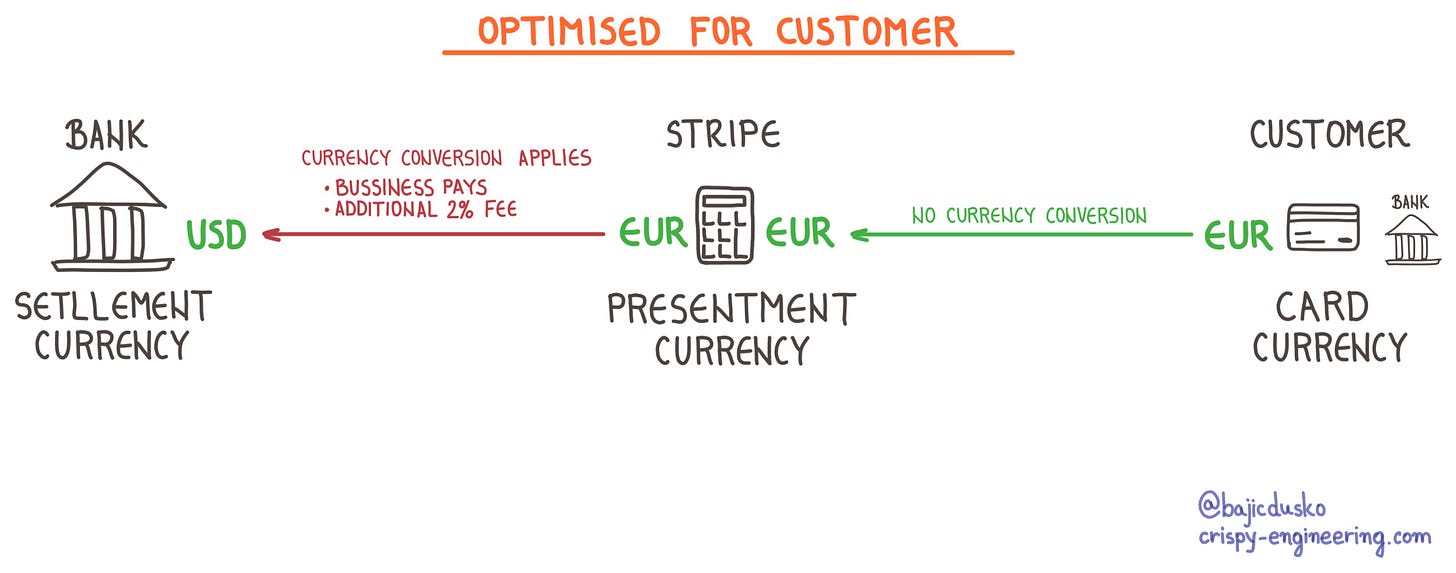

For businesses, currency conversion happens when the card is charged in a different currency than the settlement currency.

Fortunately, businesses can affect this by choosing the charge currency for transactions. This is also called a presentment currency, as the product price will be presented to the customer with that currency.

Almost always, businesses match presentment currency with settlement currency, in order to avoid additional transaction costs. This also means that the costs of currency conversion are transferred to the customer, as the customer bank will do the currency conversion from local currency to presentment currency.

A negative side effect of this is that customers will see one price on the product, and they will be charged more, due to the local bank FX rate. This leads to unclear costs to customers.

In some businesses (especially in service B2C), customers will complain about unclear costs. This is where the business can offer customers the choice of the currency they wanna be presented/charged with (the customer decides about the presentment currency).

This means that the transaction could be more expensive for the business, but on the other hand, the business could generate more sales due to the best user experience.

This results in the most expensive version of transactions for a business.

If you’re starting the business, a piece of advice is to always match presentment currency with settlement currency.

Your customers will see the price in foreign currency and they will expect some currency conversion on their side.

Othewise, transaction costs become too expensive.

UX dark pattern in presenting the product price

What businesses should never do, is “localize” the prices to customer currency, and charge in another currency.

Gumroad is letting this “UX dark pattern” happen.

On Gumroad you can present the price of your product in EUR, but the customer will be charged in USD every time. They do the currency conversion for UI purposes only. It’s safe to say that the FX rate that Gumroad used is different from the FX rate of your bank.

This means that the price that customer sees and the charge amount on their card will be different due to currency conversions applied by their bank.

Be extra careful, if you intend to make a conversion from one currency to another, just for the localization's sake. No one likes to be charged for something they didn’t expect.

In summary

When selling your digital product, make sure to think about card processing fees early by factoring in:

Your location (business currency)

Customer location (customer currency)

This way you will be able to mitigate additional costs from:

cross-border fees

unwanted currency conversion

and currency conversion fees.

It’s important to remember if you have a huge transactional volume, you can always negotiate better terms with Stripe. Any payment processor will rather do the discount than let you redirect your traffic to some other payment processor.

At some point, the leverage is on the business side.

This is super in-depth! Thanks for sharing, Dusko!

When it comes to Stripe, the company offers a number of different payment options to its customers. Among these are the standard Stripe fee, which is based on the https://www.ipprism.com/ amount of money being transferred, and the stripe_fee_percentage, which is a percentage of the amount being transferred.